30 years of serving clients and creating financial plans have taught me these realities:

- Too Many Variables + Too Much Time = Life Will Surprise You!

- Financial Planning is Numerical Fiction

- Financial Plans are Often Worthless

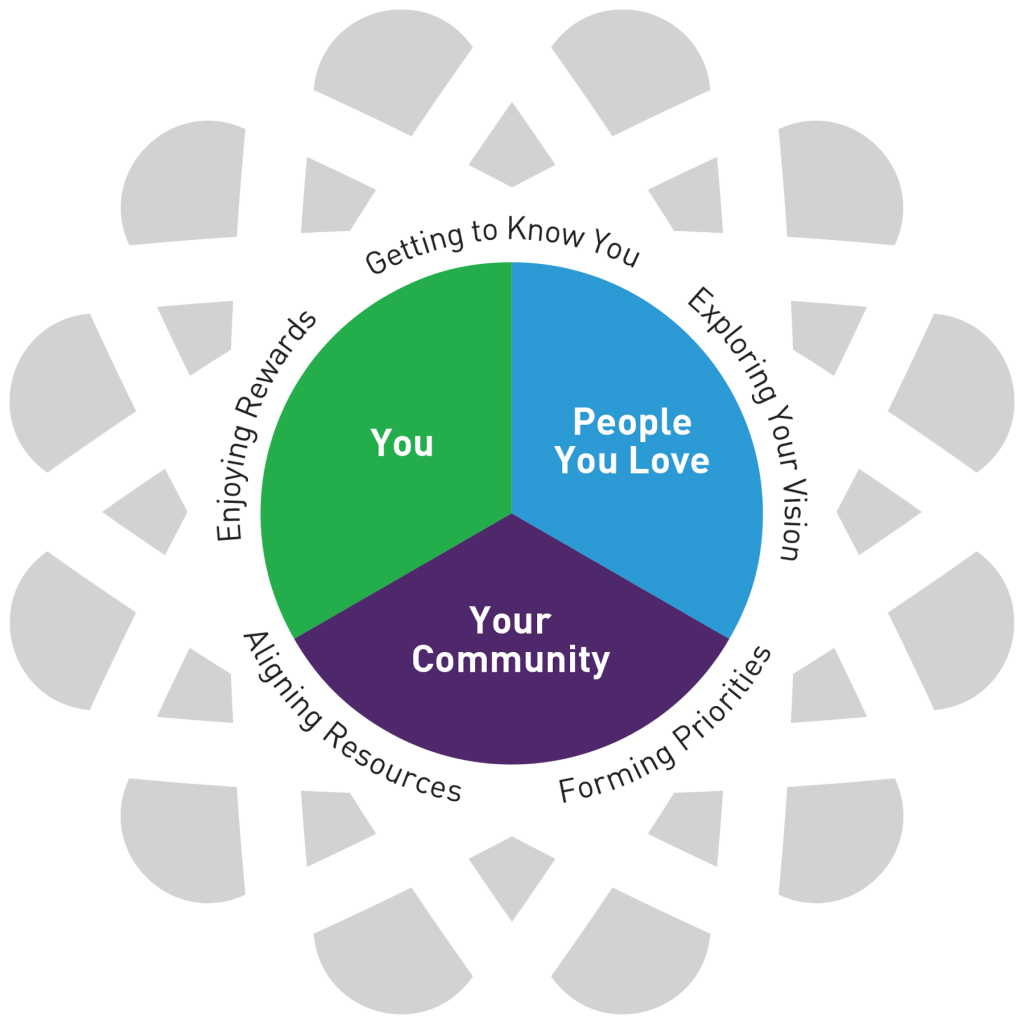

Embraces the reality that life is uncertain, priorities evolve and there are tremendous unknowns within tax laws, financial markets, interest rates, inflation, lifestyles, families, healthcare, wellness, longevity and many other variables.

Empowers you to live, adapt and adjust in alignment with your personal values and priorities, while leading to better experiences for you and the people you care about.

Like a CFO hired for a business, my compensation is aligned with the responsibility for getting a job done the right way, at the right time.

Life-Centric Planning does not require investments under management or any financial products. There are no commissions or hidden incentives.

It is most fitting for people who can afford a commitment between $500 and $5,000 per month for six months or longer. For a business owner or leader, the cost can be tax-deductible and less than a basic assistant.

Your fee will be a transparent and customized monthly or quarterly amount. It will be determined appropriately, based on the complexities of your situation, the value of your time and resulting accomplishments, and other factors relevant to you.